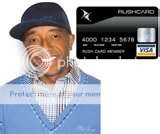

What’s wrong with the Rush Card by Russell Simmons? Well, I find a lot wrong with the concept of the card. The main concept behind the card is that the card caters to those without a bank account and the target market group is minorities, specifically African Americans. I can make this assumption because Simmons is one of the Forefathers of Hip Hop music, which has become synonymous with African Americans and the Black community in general. Instead of teaching his target market group to be more financially responsible so they can have a bank account, he is giving his customers a way to continue to neglect any debts they may have with banks and use HIS card.

The Rush Card website claims to help you achieve your financial goals by only allowing the customer to spend what is on the card (added with other financial lessons this not a bad idea), but this teaches very little financial responsibility as far as learning how to manage money within a banking institution. You can’t overdraw the card since you only can spend what you have (again not a bad concept if it were coupled with financial education). Many methods of debt reduction and financial responsibility use this same method, but with cash. Once the money is gone it’s gone. Simmons is assuming that his customers are learning this lesson on their own. The Rush Card carries no interest, like a credit card does, but also offers no sort of savings option.

The Rush Card is used just like a debit card and can be used anywhere Visa cards are accepted. The website claims to report to the credit agencies when used to pay bills. Just paying your bills on time each month does the same thing.

There are a few positives associated with the Rush Card like being able to track your spending. But again, most banks now offer this feature and there are many websites that track your spending and much more.

Simmons has now added a prescription discount card and discount health care plans that are associated with the card. This is good because many people who are not responsible enough to have a bank account also do not have access to these health care features. Many people in general do not have access to these health care options.

Looking a little closer at the Rush Card website, I noticed a tab for Fees. Isn’t the point of the Rush Card to have no fees, like he claims bank accounts and credit cards do? There are a lot of fees associated with this card that you can check out for yourself here.

Is the Rush Card a scam? Well, yes and no. I say yes because Simmons is offering a “convenient” alternative to having a traditional bank account and if used as a tool towards financial independence can educate about spending, tracking your spending, and even saving. I say no because Simmons is in no way educating about proper financial responsibility. Why not just open a bank account? I’m guessing here, but I would say many of the Rush Card users can’t use traditional banks because they owe the banks money. There is no education of how to manage a bank account, thus little education towards managing and maintaining your money.

Instead of using the Rush Card, open a basic checking account with a bank (most banks offer checking accounts that are fee free for a variety of reasons, such as using direct deposit). If you owe banks so much money you can’t get an account, then you should be reaching out to someone or working on your overall debt reduction because more than likely if you owe banks, you owe others.

Used as a tool, the Rush Card can be effective in financial management. One method could be to use the Rush Card as a secondary method of spending, but then you still have to deal with the fees associated. I suppose the card could be used as a beginning tool towards financial independence, but there are much better methods out there.

I can’t knock Russell Simmons’s hustle, because after all it is a recession and everyone needs a side hustle, but in this instance I see him as a vulture preying on the financially uneducated. Instead of using the Rush Card, get your finances in order.

Your future will thank you….

In a lot of ways the Rush card is good. When you use it properly, you do understand money management, budgeting, setting financial goals and so on. Which is pointing you in the direction of getting your finances in order. After what has happened in the banking Industry, do you think we can still trust them? Writer you really should be a lot kinder.

ReplyDeleteThanks Rush!